Artificial Intelligence is being widely adopted by the investment world, taking trading to a whole new level as extreme volatility in markets can make it hard for even seasoned investment professionals to operate. The ability of AI-powered trading systems to analyze vast amount of information in real-time and execute trades with greater accuracy has led to a rapid adoption of AI trading systems by hedge funds, investment professionals and even retail traders to generate alpha in their portfolios.

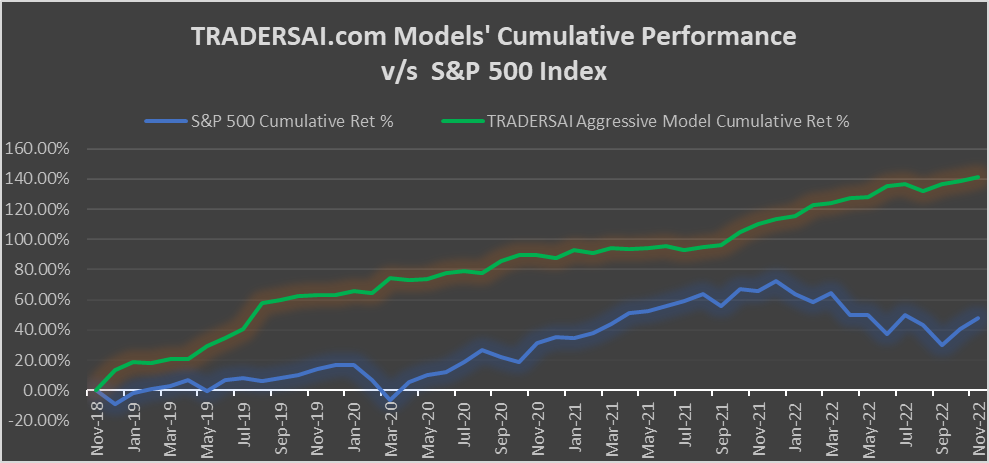

Amid unprecedented volatility and choppiness in the market over the last four years our proprietary AI-based trading systems have delivered outstanding performance as is evidenced by our published, publicly verifiable Results.

A further testament to our models’ robustness and fundamental strength came recently in the form of an article that reported on the analysis of the published performance of our trading strategies in the CFA Institute‘s publication:

What Can AI Do for Investment Portfolios? A Case Study | CFA Institute Enterprising Investor

“Traders’ A.I. outperformed its benchmark, the S&P 500, over the three-year analysis period. While the strategy was neutral with respect to long vs. short, its beta over the time frame was statistically zero.“

Yes, ZERO Beta. Pure Alpha.