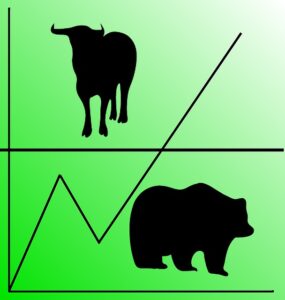

Buy the Rumor, Sell the News? The earnings season kicked off this week with impressive earnings so far. Even Apple’s event gave rise to talks of “super cycle”. Yet, the market action is underwhelming at best. Likely the result of the “buy the rumor, sell the news” at play. In our Friday’s morning trading plans, (more…)

Earnings Season Started! In our Friday’s morning trading plans, we wrote: “Whatever may be one’s explanation – or, lack there of – for the market melt-up this week, the market has regained its upside bias and appears likely to close the week strong. It takes a daily close below 3390 to negate it”. If you (more…)

If You Wondered What a Melt-up Meant In our Friday’s morning trading plans, we wrote: “Whatever may be one’s explanation – or, lack there of – for the market melt-up this week, the market has regained its upside bias and appears likely to close the week strong. It takes a daily close below 3390 to (more…)

Capping the Week with a Melt-up Whatever may be one’s explanation – or, lack there of – for the market melt-up this week, the market has regained its upside bias and appears likely to close the week strong. It takes a daily close below 3390 to negate it. 3410-3380 is the key range our models (more…)

The Bull Standing Its Ground…for Now Jobless claims worsening week by week, covid-19 getting worse, economy seems to be falling into an abyss…yet, the stock market is gunning back towards its all-time highs. Easy money flowing into stocks? Whatever may be your explanation, the market has regained its upside bias and it takes a daily (more…)

Politics in Over-drive Adding to the Stimulus Uncertainty “The only game in town until earnings season kicks in soon” that we referred to in our trading plans yesterday is now thrown into further disarray with what appears to be Trump’s familiar temper tantrum that halted any stimulus negotiations until after the elections. For our models, (more…)

Stimulus Deal, the Next Catalyst Markets are counting on – and, awaiting – the stimulus deal to make any real move in either direction. Unless something changes dramatically, that is the only game in town until earnings season kicks in soon. 3410-3370 is the key range our models are monitoring for today. Read below to (more…)

Goldilocks Counting on Stimulus Money Covid-19, worsening jobs scenario, potential political upheaval are being balanced (at least, for now) by investors’ hope for stimulus money freely flowing and feeding the market bull. At least, that is the theme the markets appear to be starting the new trading week with. 3330-3380 is the key range our (more…)

Corona Scare or New Stimulus Hope? The theme of our trading plans all this week has been: “It remains to be seen if the climb up this week so far is for real or if it would fizzle out on Friday, 10/02”. Sure enough, this morning, Friday, 10/02, we are seeing a re-evaluation of the (more…)

Unsustainable Flows or Next Bull Leg? Today’s market action could be skewed by first-of-month systematic investment flows. Today’s daily close and tomorrow’s early action could hold clues to the next leg of the markets. It remains to be seen if the climb up this week so far is for real or if it would fizzle (more…)