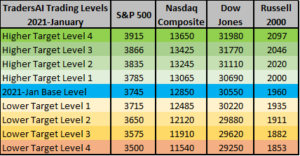

This Red-hot Bull Missing Something? Our trading plans yesterday stated: “With the elections drama coming to a climax (or, anti-climax, depending on your perspective), markets could be slowly coming back to focusing on the basics: economy, the virus and its impact on the economy, interest rates, inflation, dollar weakness, jobs, unemployment, and so on. Of...