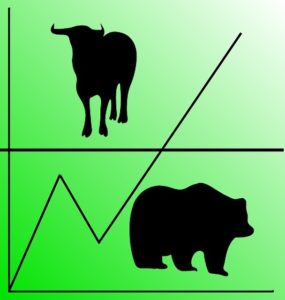

Key Levels Still Being Fought Our models are not sporting any directional bias as they are watching the key 2830-2850 level for a breakout or rejection. A breakout above would have the bulls gunning for 2900 and then 2940, IF they can manage to close above the key levels today. Models caution against shorting for (more…)