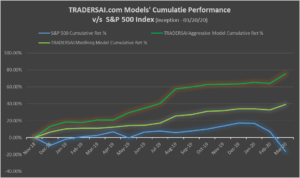

Real Market Sentiment to Reveal Itself Today! As many veterans on the markets have been referring to, the last few days of “bounce” in the markets could be mainly driven by the quarter-end portfolio asset allocation re-balancing (back to 60/40 equity/bond model). Some part of the “window dressing” flows could also have propped up the (more…)