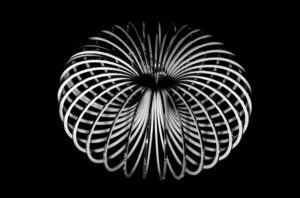

Fun Ride? Precarious Ride? This rally – interspersed by brief dips – might feel invincible and fun to be a part of…while it lasts. While most Wall Street veterans are sounding caution on valuation basis and the state of the economy, the pumping from the Fed seems to be keeping the bulls afloat. When it...