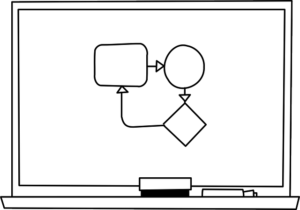

Consolidation Ahead? Day 6 Unless the index closes above 4120 today, our models indicate continued choppy trading until some unexpectedly positive macro development shows up. If the index closes above 4120 today, then we expect the choppy consolidation to be complete and a probable onset of another bullish leg, pending further confirmation. Positional Trading Models: (more…)