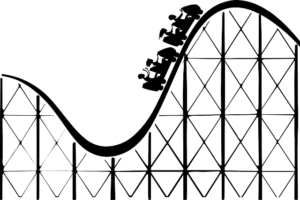

Roller Coaster Ride – Day 2 Our trading plans published yesterday, Tue. 01/24, stated: “With yesterday’s daily close above 3985, our models have flipped to a bullish bias and will remain bullish while the index is above 4000. Nevertheless, models indicate a rather choppy market while the index is below 4015”. As hypothesized, the market (more…)