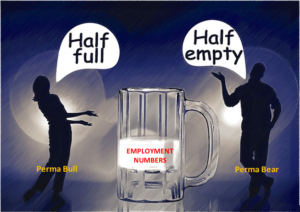

This Morning’s “No Inflation, No Problems” (Good) News Bad for the Markets? The CPI release this morning points to no concerns about inflation or the health of the economy. While this is good for the common man, and the general well being of the economy, the equity market players could take this as (more…)