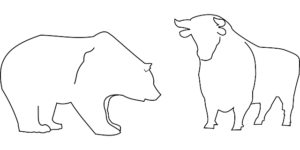

Bear Trap Yesterday or Bull Trap Today? Our models’ indication of the critical range of 3340-3380 – reiterated for the last many days – was tested on Thursday with the session low coming close at 3341.02, followed by a clear break down on Friday, 02/21, with the session low coming in at 3328.45! And, as (more…)