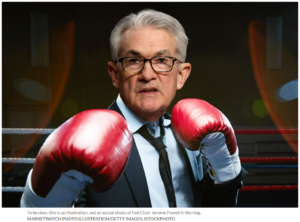

S&P 500 INDEX MODEL TRADING PLANS for THU. 05/11 As we wrote in our published Trading Plans yesterday, “The post-CPI market action so far is underwhelming at best – looks like the markets are waiting for a confirmation from the PPI release tomorrow”. The post-PPI data this morning proved to be even more of a (more…)