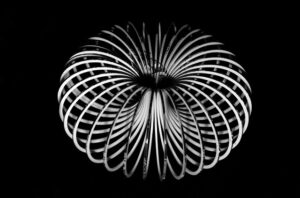

Coiled Spring Likely to Unleash Big Move in Either Direction Russia’s invasion of Ukraine, Allies’ sanctions on Russia and potentially Russian Oil, and the associated surge in oil prices seems to have their impact already baked into the market prices. The wild card is going to be the upcoming FOMC rate decision, which also might (more…)