Results of Published Model Entries and Exits for Wednesday 06/05

Find below the detailed outcome tracking of our models’ trading plans for the day, as well as the results for the last month:

NOTE: The index by itself is NOT tradable. The model plans here based on the S&P index level can be used to trade any instrument that tracks the index – the futures on the index (ES, ES-mini), the options on the futures (ES options), the SPX options, the ETF SPY are just a few examples of the instruments one can adapt these plans to.

These plans and results are hypothetical and NOT an investment advice to buy or sell any specific securities but are intended to aid – as informational, educational, and research tools – in arriving at your own investment/trading decisions. Please read the full disclosures at the bottom of this article for additional notes and disclaimers.

Trading Plans/Forecast Published Wednesday Morning – Medium-Frequency Models

“For today, Wednesday 06/05, our medium-frequency models indicate staying out of the markets.”

Trading Plan Results/Outcome

Wed 06/05: Stayed out of the market

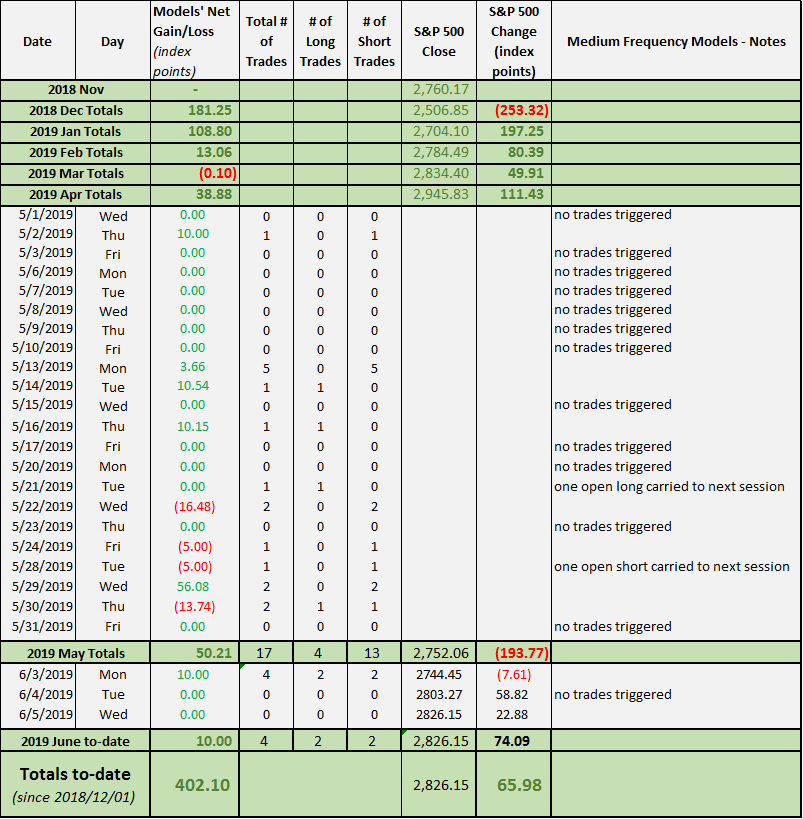

Past results this month – medium frequency models (hypothetical trades based on the trading plans published before markets open daily):

Trading Plans/Forecast Published Wednesday Morning – Aggressive Intraday Models

“For today, Wednesday 06/05, our aggressive intraday models indicate going long on a break above 2805 or 2820 with an 8-point trailing stop, and going short on a break below 2825 or 2815 or 2802 with a 6-point trailing stop. If the market gaps up or down and these levels are not crossed during the regular session hours, one should NOT be chasing the markets but taking the trades only if/when given.”

Trading Plan Results/Outcome:

Wed 06/05: The aggressive intraday models booked a net +20.99 index points in gains on three longs and three shorts

Past results this month – aggressive intraday models (hypothetical trades based on the trading plans published before markets open daily):

(i) This and other articles in the blog contain personal opinions of the author and is NOT representative of any organization(s) he may be affiliated with. This article is solely intended for informational and educational purposes only. It is NOT any specific advice or recommendation or solicitation to purchase or sell or cause any transaction in any specific investment instruments at any specific price levels, but it is a generic analysis of the instruments mentioned.

(ii) Do NOT make your financial investment or trading decisions based on this article; anyone doing so shall do so solely at their own risk. The author will NOT be responsible for any losses or loss of potential gains arising from any investments/trades made based on the opinions, forecasts or other information contained in this article.

(iii) Risk Warning: Investing, trading in S&P 500 Index – spot, futures, or options or in any other synthetic form – or its component stocks carries inherent risk of loss. Trading in leveraged instruments such as futures carries much higher risk of significant losses and you may lose more than you invested in them. Carefully consider your individual financial situation and investment objectives before investing in any financial instruments. If you are not a professional trader, consult a professional investment advisor before making your investment decisions.

(iv) Past performance: This article may contain references to past performance of hypothetical trades or past forecasts, which should NOT be taken as any representation or promise or guarantee of potential future profits. Past performance is not indicative of future performance.

(v) The author makes no representations whatsoever and assumes no responsibility as to the suitability, accuracy, completeness or validity of the information or the forecasts provided.

(vi) All opinions expressed herein are subject to change at any time, without any notice to anyone