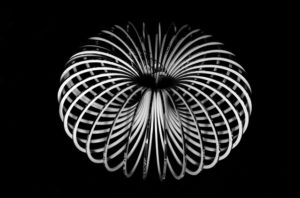

Markets Getting Tightly Wound Up? Markets are getting tightly wound up in the wake of the much hyped geopolitical tensions from last week. While the tensions may not be declared gone, they surely are not at a level to impact the markets adversely. This, coupled with the retail positioning, could be tightly winding the markets (more…)